2023-10-10 18:14:10 Author: securityboulevard.com(查看原文) 阅读量:7 收藏

In recent years, Decentralized Finance, commonly referred to as DeFi, has surged in popularity as a revolutionary financial ecosystem. DeFi platforms promise to democratize finance, offering decentralized alternatives to traditional banking, lending, and trading systems. However, as DeFi gains momentum, concerns about its security and safety have also come to the forefront. In this blog post, we’ll delve into the key security challenges facing DeFi platforms and explore how developers and users can ensure the safety of their assets.

What is DeFi?

DeFi platforms are built on blockchain technology, allowing users to access financial services without relying on traditional intermediaries like banks or brokerage firms. This open and permissionless ecosystem enables users to trade, lend, borrow, and earn interest on their cryptocurrencies. While this innovation has the potential to revolutionize finance, it also introduces unique security challenges.

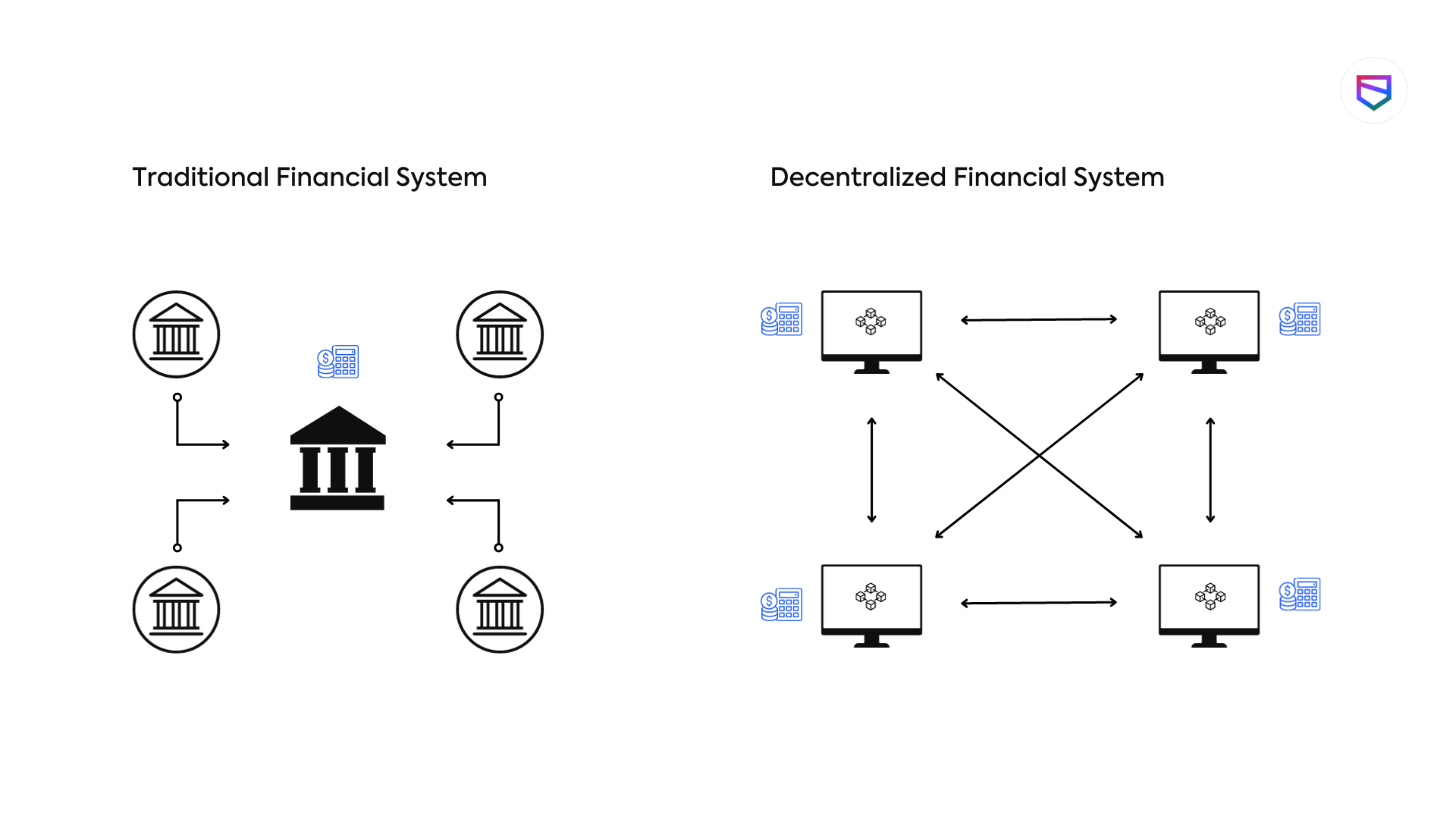

Difference Between DeFi and CeFi

DeFi (Decentralized Finance) and centralized finance (CeFi) represent contrasting paradigms in the financial industry. In DeFi, financial services are built on blockchain technology and smart contracts, enabling peer-to-peer transactions without the need for traditional intermediaries like banks. This decentralization offers greater transparency and accessibility, as anyone with an internet connection can participate in DeFi, making it more inclusive. However, it also carries risks associated with smart contract vulnerabilities and regulatory uncertainty.

In contrast, CeFi relies on centralized financial institutions, which is referred to as traditional financial systems such as banks and brokerage firms, to facilitate transactions and manage customer funds. These institutions provide a sense of trust and security but often come with higher fees, limited accessibility, and potential for censorship. CeFi is well-established and regulated, but it lacks the innovation, openness, and permissionless nature of DeFi. Both DeFi and CeFi have their strengths and weaknesses, and the choice between them depends on individual preferences, risk tolerance, and specific financial needs.

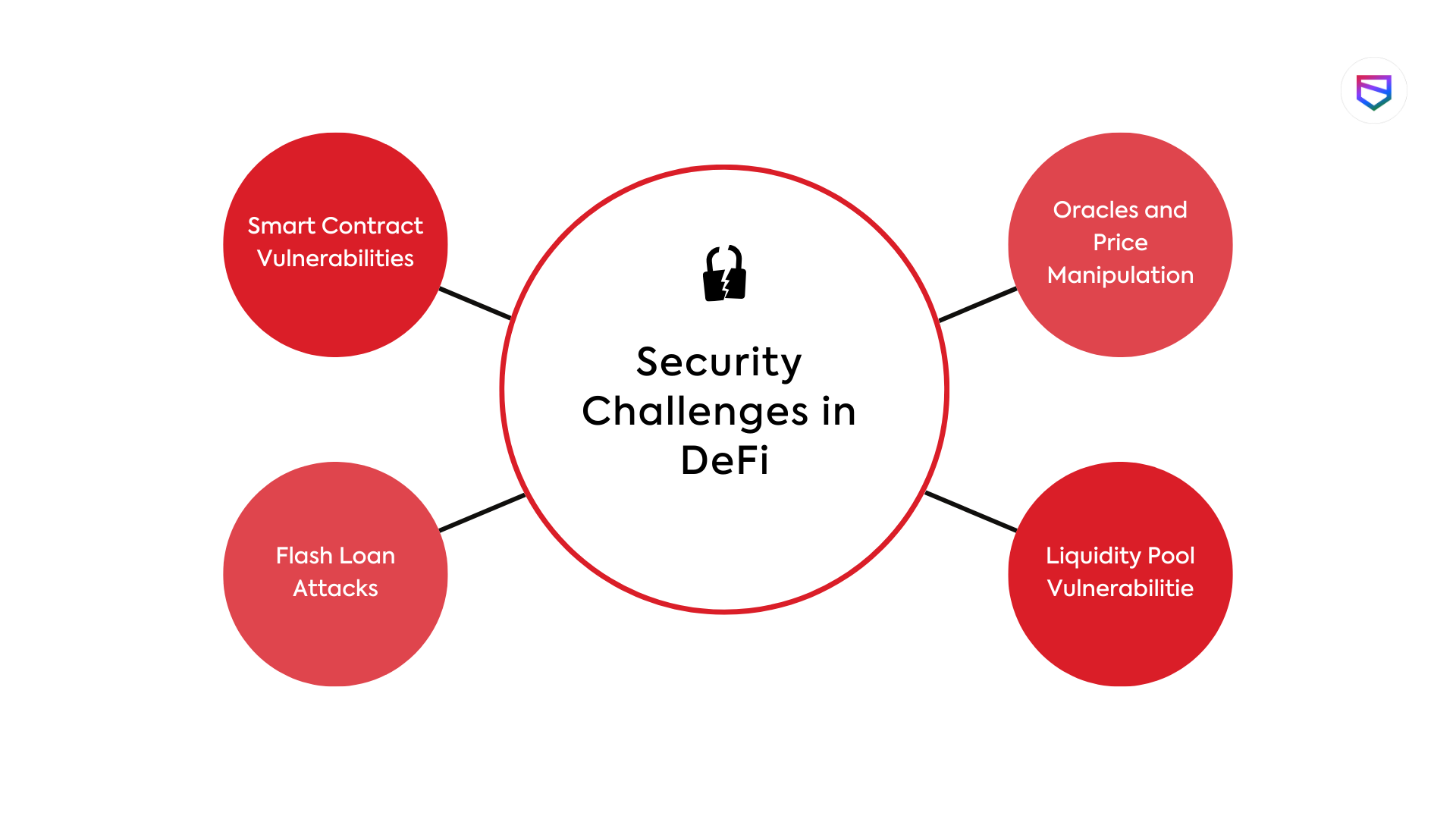

Security Challenges in DeFi

- Smart Contract Vulnerabilities: Smart contracts are the backbone of DeFi applications. They execute automatically when certain conditions are met. However, if not programmed securely, they can be susceptible to vulnerabilities that can be exploited by malicious actors. Code audits and rigorous testing are essential to minimize these risks.

- Flash Loan Attacks: Flash loans allow users to borrow assets without collateral, provided they return the borrowed funds within a single transaction. Malicious actors have exploited flash loans to manipulate prices on decentralized exchanges (DEXs) and drain funds from vulnerable protocols.

- Oracles and Price Manipulation: DeFi platforms rely on oracles to provide external data, such as price feeds. Manipulating these data sources can lead to financial losses for users. Secure and decentralized oracles are crucial to mitigating this risk.

- Liquidity Pool Vulnerabilities: Automated Market Makers (AMMs) and liquidity pools are central to DeFi trading. Vulnerabilities in these systems can lead to significant losses for liquidity providers and traders.

Ensuring DeFi Safety

- Do Your Own Research (DYOR): Before participating in any DeFi platform, research thoroughly. Read project documentation, scrutinize the code, and assess the team behind it. Be wary of platforms with anonymous developers or a lack of transparency.

- Use Reputable Platforms: Stick to well-established DeFi platforms with a proven track record of security and reliability. Some of the more established platforms have already weathered various security challenges and demonstrated their ability to protect user funds.

- Employ Hardware Wallets: Consider using a hardware wallet for storing your cryptocurrencies and assets. Hardware wallets are physical devices that store your private keys offline, making it extremely difficult for hackers to access your funds. Popular hardware wallet brands include Ledger and Trezor.

- Diversify Your Portfolio: Avoid putting all your assets into a single DeFi platform or project. Diversification spreads risk across multiple assets or platforms, reducing the potential impact of a security breach or loss on your overall portfolio.

- Keep Software Up to Date: Regularly update your wallet software, browser extensions, and any other tools you use for DeFi. Developers often release updates to address security vulnerabilities and improve performance.

- Stay Informed: The DeFi space is dynamic, and new risks and opportunities arise regularly. Stay informed by following reputable news sources, participating in DeFi community discussions, and keeping an eye on emerging trends. Being aware of potential risks and developments can help you make informed decisions.

- Beware of Phishing: Phishing attacks are common in DeFi. Be extremely cautious of unsolicited emails, messages, or links. Always double-check the URLs of websites you visit and never enter your private keys or seed phrases on suspicious sites. Consider using a password manager and two-factor authentication for added security.

- Enable Multi-Signature Wallets: Some DeFi platforms and wallets offer multi-signature functionality. This means that multiple private keys are required to authorize a transaction, adding an extra layer of security.

- Limit Exposure to Unaudited Projects: While some audited projects are still vulnerable, unaudited projects carry even higher risks. Be cautious when interacting with unaudited smart contracts or protocols, and consider the potential consequences of loss.

- Consider Insurance: Some DeFi platforms offer insurance options that can help protect your assets in case of a security breach or loss. Research and assess the cost and coverage of such insurance products to determine if they align with your risk management strategy.

As DeFi continues to evolve, regulatory scrutiny is increasing. Some argue that regulatory oversight can enhance security by weeding out fraudulent projects and enforcing standards. However, others fear that excessive regulation could stifle innovation and decentralization. Striking a balance between innovation and security remains a challenge for the DeFi community.

Conclusion

DeFi has the potential to transform the financial landscape, providing greater financial inclusion and autonomy. However, it is not without its risks. Security and safety in the DeFi space require a proactive approach from both developers and users. By conducting due diligence, using secure practices, and staying informed, individuals can mitigate risks and contribute to the long-term success of decentralized finance.

As DeFi continues to evolve, it’s essential to remember that the space is dynamic, and new security challenges may emerge. Staying vigilant and adaptable is key to navigating the ever-changing DeFi landscape safely and securely.

Recommended Reading

Social Engineering Attacks – Manipulating your thoughts to fall in trap

Blockchain Network is Secured! But not the apps and their Integrations

Psychological Manipulation in Social Engineering: Unveiling the Tactics

The post Security and Safety of Decentralized Finance (DeFi) Platforms appeared first on WeSecureApp :: Simplifying Enterprise Security.

*** This is a Security Bloggers Network syndicated blog from WeSecureApp :: Simplifying Enterprise Security authored by Khushboo Chahal. Read the original post at: https://wesecureapp.com/blog/security-and-safety-of-decentralized-finance-defi-platforms/

如有侵权请联系:admin#unsafe.sh