2023-10-13 16:9:13 Author: blogs.sap.com(查看原文) 阅读量:14 收藏

This blog illustrates selected highlights in the area of Governance, Risk, and Compliance (GRC) with SAP S/4HANA Cloud, private edition 2023. This time, we focus on innovations from SAP S/4HANA for International Trade, SAP Document and Reporting Compliance, SAP Financial Compliance Management, SAP Privacy Governance, and SAP Cloud Identity Access Governance.

This blog covers the following topics:

SAP S/4HANA for International Trade

- Intrastat

- Integration with SAP Global Trade Services

SAP Document and Reporting Compliance

- Electronic Document Consistency Check

- Automated Error Notifications During Electronic Documents Processing

- Additional Scenarios for Electronic Invoicing

SAP Financial Compliance Management

- Operational Dashboard

- GRC Business Content Service

- Integration with SAP Signavio

- Effectiveness Testing in SAP Financial Compliance Management

- Podcast: The Future of ERP – Changing the Way People Work with Business Process Intelligence and Automated Controls

SAP Cloud Identity Access Governance

- Additional Workflow Options to Support Business Requirements

- Administrator View to Manage Privileged Access Management ID

- Mass Maintenance of Business Roles

If you are interested in what is new with SAP Process Control, SAP Risk Management, SAP Audit Management, and SAP Business Integrity Screening, please refer to two excellent blogs by Thomas Frenehard:

- GRC Tuesdays: What’s New in SAP Process Control and SAP Risk Management

- GRC Tuesdays: What’s New in SAP solutions for Three Lines

Intrastat

New Parameters for Specification of Declaration Month in Intrastat Selection Apps

As of SAP S/4HANA 2023, the Current Month and Previous Month parameters for specification of the declaration month are available in the following Intrastat selection apps:

- Select Dispatches and Customer Returns – Intrastat Declaration

- Select Receipts and Returns to Supplier – Intrastat Declaration

By selecting the Current Month parameter option, the declaration month is calculated as the month of the job execution date.

By selecting the Previous Month parameter option, the declaration month is calculated as the month previous to the month of the job execution date.

Support of Intrastat Declarations for Malta

Intrastat declarations for Malta are supported as of SAP S/4HANA 2023.

Further Custom Fields in Intrastat Declaration Items

Prior to SAP S/4HANA 2023, there were three custom fields in Intrastat declaration items with 5, 10, and 15 characters.

With SAP S/4HANA 2023, there are three more custom fields in Intrastat declaration items with 20, 40, and 40 characters.

You can fill these custom fields by using the BAdI BADI_INTRASTAT_SELECTION.

New Fields in ‘Define Default Values for Purchasing’ IMG-Activity

Two new fields:

- Business Transaction Type for Returns to Supplier

- Procedure for Returns to Supplier (only relevant for Cyprus and France)

- Further Custom Fields in Intrastat Declaration Items

Prior to SAP S/4HANA 2023, there were three custom fields in Intrastat declaration items with 5, 10, and 15 characters.With SAP S/4HANA 2023, there are three more custom fields in Intrastat declaration items with 20, 40, and 40 characters.You can fill these custom fields by using the BAdI BADI_INTRASTAT_SELECTION. - New fields in ‘Define Default Values for Purchasing’ IMG-Activity

Third Party Declarants for Croatia

In Croatia, as of SAP S/4HANA 2023, it is possible to assign third party declarants to providers of information and create Intrastat declarations with information relevant for third party declarants.

Integration with SAP Global Trade Services

New App ‘Schedule Transfer of Product Attributes’ (2U1)

New app to schedule the transfer of product attributes for special customs procedures to the SAP Global Trade Services system. With this app, product attributes for special customs procedures can be transferred to SAP Global Trade Services in a batch manner in SAP S/4HANA Cloud.

Electronic Document Consistency Check

Tax authorities have been continuously increasing the number and the complexity of legal mandates and, lately, they have been moving toward continuous transactions controls. These translate to business processes extended with an additional step that sends business documents to the tax authorities for registration / approval before business transactions can take place. And, as a result, tax authorities collect all data required to automatically verify returns upon submission or even prepare draft returns on behalf of tax payers.

SAP Document and Reporting Compliance allows you to automatically check the consistency of business transactions between SAP S/4HANA and tax authorities’ platforms to early identify discrepancies and allow enough time for corrections prior month-end. In addition, you can centrally review the findings and initiate corrections. This way, you can ensure traceability and minimize the risk of noncompliance at the time of returns submission.

Value Proposition

- Gain real-time insights into your compliance status

- Proactively identify inconsistencies of electronic documents and centrally review findings

- Streamline remediation of inconsistencies to ensure full consistency between electronic documents in the system of records and the data collected by tax authorities

- Minimize risk of non-compliance when tax authorities reconcile periodic tax returns to the records collected in real-time or near-real time in their platforms

Capabilities

- Automate consistency checks between the electronic documents in the system and the ones stored in the tax authority’s system or local platforms

- Centrally review inconsistencies

- Initiate corrections of inconsistencies

Fig. 1: With the consistency check for electronic documents, you can proactively check the consistency of business transactions between SAP S/4HANA and the data of the tax authorities

Fig. 2: With the consistency check for electronic documents, you can review inconsistencies and initiate corrections

More Information

- SAP Help Portal: Check Electronic Document Consistency

Additional Scenarios for Electronic Invoicing

Since last year, the ready-to-use scenarios have been expanded to cover 497 legal requirements (81 new scenarios since the 2022 release of SAP S/4HANA) across 57 countries, including newly released electronic invoices for Poland, Romania, Slovakia, and Egypt. The full list of ready-to-use compliance scenarios currently available can be found here:

Automated Error Notifications During Electronic Documents Processing

SAP Document and Reporting Compliance allows you to comply with local regulations, including automated creation and electronic exchange of business documents in the required format. The ’Manage Electronic Documents’ app allows you to review electronic documents and manage corrections across countries.

With the new release, you can proactively notify errors by sending emails to predefined mailboxes (e.g. support teams or individual users) or setting up automated notifications to specific users. From the notification or the document list (Logs tab or Error Tag), you can easily navigate to the ‘Error Analysis’ page, which provides a streamlined view by error type and assists you in troubleshooting errors, retriggering email notifications and initiating corrections. Another enhancement with electronic documents processing is the option to manually create electronic documents when, for example, automatic creation fails or electronic document needs to be recreated upon update of underlying business transaction.

Value Proposition

- Accelerate corrections by automatically notifying responsible person when errors occur and avoid late submission due to errors

- Maximize efficiency by prompting user actions when required and preventing unnecessary manual monitoring

- Increased usability

- Seamlessly handle special case electronic documents e.g. recreate e-documents previously deleted

Capabilities

- Set up automated error notifications for specific users by error category

- Review error by category, manually send email notification and initiate corrections

- Manually create electronic documents when automatic creation fails or original documents are deleted with new SAP Fiori app ‘Create Electronic Documents Manually – Special Cases’

Fig. 3: Thanks to the automated error notifications during electronic documents processing, you can proactively trigger error notifications during electronic documents processing

Fig. 4: With the new functionality, you can manually send e-mail notifications

Fig. 5: In addition, you can review errors and initiate corrections of your electronic documents

More Information

- SAP Help Portal: Configuring Error Notifications

- SAP Help Portal: Create Electronic Documents Manually – Special Cases

Operational Dashboard

Compliance specialists now benefit from full transparency into the status quo of issue and remediation management provided by the ‘Issues Overview’ app. Thanks to the intuitive dashboard, they are guided by the system to those issues that require their attention and can directly drill-down to take immediate action.

Value Proposition

- Real-time insights and full transparency regarding issues and remediation

- Intuitive and easy-to-use graphical user interface with personalization options

- Reduce reaction time by guiding the users where to take action

- Easy-to-use dashboard

Capabilities

- Pre-defined cards to analyze most frequently used topics:

- Issues by conclusion

- Open issues by status

- Tasks by due date and priority

- Validation findings needing follow-ups

- Transferred issues to external case management systems by risk level

- Additional cards:

- Task processors

- Issue owners

- Quick links for direct access to related apps

Fig. 6: The operational dashboard in SAP Financial Compliance Management provides full transparency for compliance specialists regarding issue and remediation management

GRC Business Content Service

The GRC Business Content Service allows partners to become content providers and offer content (for example, predefined controls) for SAP Financial Compliance Management through standardized packages to customers. Using ‘the Manage Business Content Objects’ and ‘Manage Business Content Packages’ apps, content providers can create, manage, and maintain content packages to be consumed by their own customers.

Value Proposition

- Provides a scalable business model and distribution channel for content providers

- Enables efficient and fast consumption of predefined content for customers, such as controls and automated procedures

Capabilities

Content can be:

- Provided by different parties via content packages

- Deployed in a standardized way

- Run out of the box

- Package can be updated by content provider

- Made available to the customer and ready to be installed as and when required

Figure 7: The GRC Business Content Service for SAP Financial Compliance Management makes it possible for partners to also become business content providers.

For partners who would like to become content providers:

- To publish your own content package on SAP Store, apply via SAP PartnerEdge via Link

Integration with SAP Signavio

The integration of SAP Signavio with SAP Financial Compliance Management enables you to monitor business critical processes in SAP Signavio and carry out compliance-relevant checks on those processes to ensure their effectiveness.

Value Proposition

- Help ensure that process and control repositories are consistent in both SAP Signavio and SAP Financial Compliance Management

- Reduce the amount of manual maintenance, thereby saving time and effort

Capabilities

- Load processes directly from SAP Signavio

- Push controls from SAP Financial Compliance Management to SAP Signavio

Fig. 8: Integration of SAP Financial Compliance Management with SAP Signavio – View in SAP Signavio

Figure 9: Integration of SAP Financial Compliance Management with SAP Signavio – View in SAP Financial Compliance Management

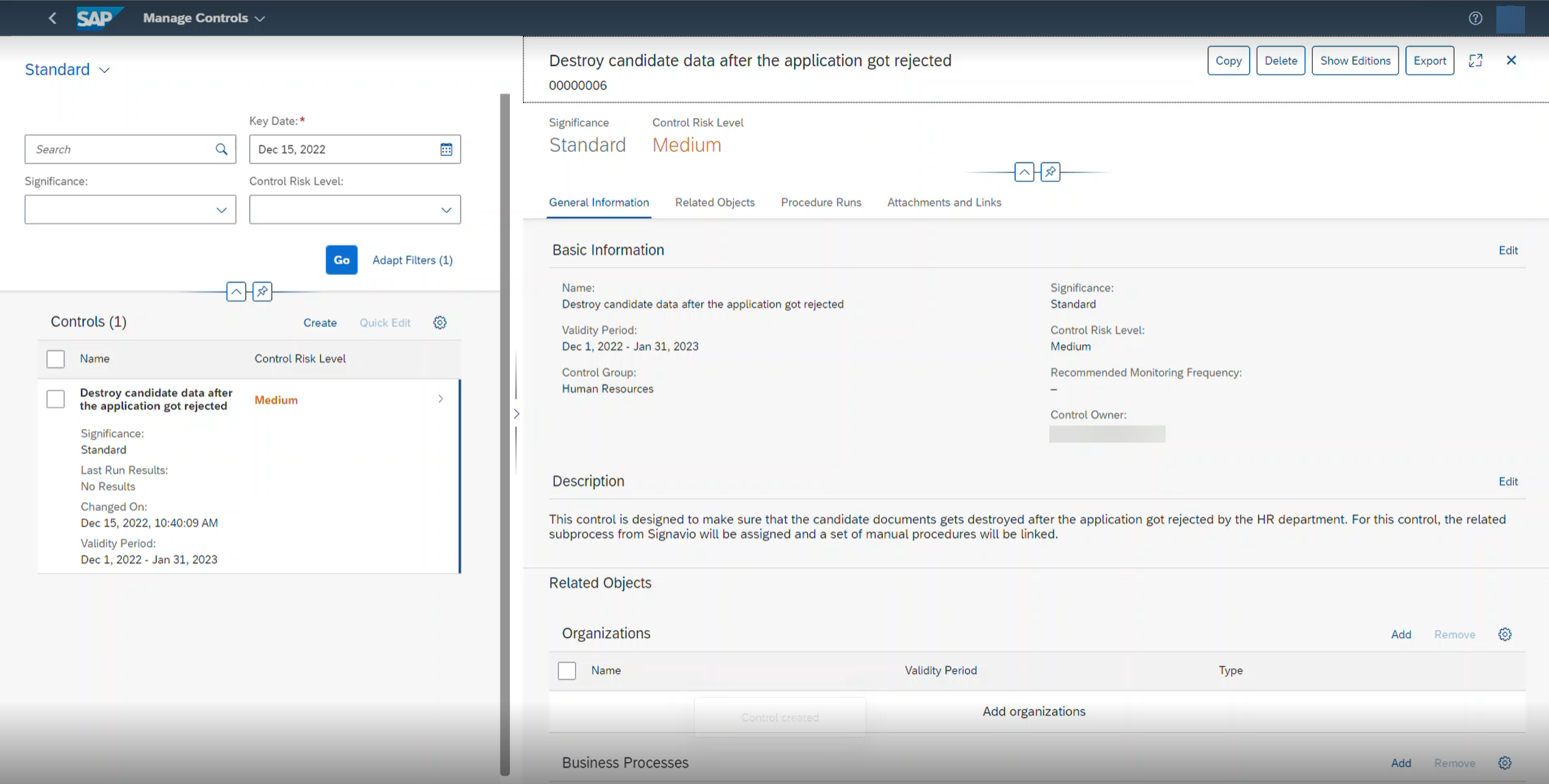

Effectiveness Testing in SAP Financial Compliance Management

SAP Financial Compliance Management supports assurance activities that you can select to check the effectiveness of your compliance checks. The assurance activities enables you to find any blind spots in your compliance strategy by testing whether your controls function in the intended way. Furthermore, you can ensure that your organization meets all obligations to ensure financial compliance by checking that implemented controls are sufficient.

Value Proposition

- Profit from an assurance map based on the results from assurance activities

- Efficiently support second line-of-defense requirements for compliance use cases, such as compliance with the Sarbanes-Oxley Act (SOX)

Capabilities

- Create and implement manual and automated procedures for different assurance activities

- Test controls for efficiency

- Schedule work packages for different assurance activities

Fig. 10: With SAP Financial Compliance Management, it is now possible to check the effectiveness of your compliance checks

Podcast: The Future of ERP – Changing the Way People Work with Business Process Intelligence and Automated Controls

If you are interested to discover the future of business process intelligence and automated controls. Listen to the episode six of our podcast series ‘The Future of ERP’. In this episode called ‘Changing the Way People Work with Business Process Intelligence and Automated Controls‘, Deloitte’s Jan Gruene and SAP’s Dr. Neil Patrick discuss business process intelligence, its benefits to organizations, and how automation can help optimize internal controls around finance, compliance, and sustainability.

Fig. 11: The new ‘Future of ERP’ podcast discusses the future of business process intelligence and automated controls

Additional Workflow Options to Support Business Requirements

Additional workflow configuration options to support various business requirements :

- Auto Approval Stage for Auto Provisioning: You can now configure an auto approval stage and path and use this path in business framework for any initiator condition.

- Business Rule Framework for Configurable Workflow and Initiator Rules: This feature helps you to create routing rules, conditions, and path in Business Rule Framework. You can also configure initiators for paths.

- Dedicated Optional Risk Owner Stage: You can configure an optional Risk Owner Stage in a workflow path to route a request to better manage unmitigated risks.

Benefits

- Customize the workflow as per the process needs

- Automatically approve noncritical assignment requests

Capabilities

Improved workflow to enable additional customization:

- Optional auto-approval and risk-owner stage

- Administrator ability to cancel a request

More Information

- SAP Help Portal: What’s New

- SAP Help Portal: Setting Up Workflow Service

Administrator View to Manage Privileged Access Management ID

The new Manage PAM session app allows the administrators to view all PAM IDs that exist, are in use and/or inactive. The app also lists additional information on session status, validity of the PAM ID, information on when the session was started and reasons for which the PAM IDs are required.

Benefits

- Increase administrator visibility into PAM ID assignments

- Obtain insights into the PAM IDs that are currently in use and the systems they’re being used in

- Provide transparency into the PAM ID log review status

Capabilities

- New administrative view that will provide insight into the assignment and use of the privileged access management (PAM) ID to better manage the process

More Information

- SAP Help Portal: What’s New

- SAP Help Portal: Manage PAM Session

Mass Maintenance of Business Roles

This feature provides capability to upload multiple new business roles and also update existing business roles attributes using the file upload. You can download the template for business roles.

Benefits

- Simplify the creation and maintenance of business roles

- Streamline the process for frequently updated attributes

- Boost transparency through an auditable process

Capabilities

- Import the “business roles” definition from a file

Maintain multiple attributes for one or more existing business roles at any given time

More Information

- SAP Help Portal: What’s New

- SAP Help Portal: Business Role Mass Maintenance – File Upload

Other SAP S/4HANA Cloud and SAP S/4HANA Enablement Assets

SAP S/4HANA is the foundation of the intelligent enterprise and is an innovative, robust, and scalable ERP. We at Cloud ERP Product Success and Cloud Co-Innovation offer a service as versatile as our product itself. Check out the numerous offerings our Enablement team has created for you below:

Further Information:

- GRC Collection Blog here

- SAP S/4HANA Cloud, public edition release info here

- Latest SAP S/4HANA Cloud, public edition release blog posts here and previous release highlights here

- Product videos for SAP S/4HANA Cloud and SAP S/4HANA

- SAP S/4HANA PSCC Digital Enablement Wheel here

- SAP S/4HANA Cloud, Public Edition Early Release Series here

- Inside SAP S/4HANA Podcast here

- openSAP microlearnings for SAP S/4HANA here

- Best practices for SAP S/4HANA Cloud, public edition here

- SAP S/4HANA Cloud, public edition community: here

- Feature Scope Description here

- What’s New here

- Help Portal Product Page here

Feel free to ask your questions on SAP Community here. Follow the SAP S/4HANA Cloud tag and the PSCC_Enablement tag to stay up to date with the latest blog posts.

Follow us via @SAP and #S4HANA, or myself via LinkedIn or @DeissnerKatrin

如有侵权请联系:admin#unsafe.sh