You think you have developed a sense of how to invest in the cryptocurrency market? Maybe you can look at a price graph, add a couple of indicators, and tell whether the price will rise or shrink. Or maybe you know a friend who can. Or an influencer. Do you?

Let me answer: No, you do not, even if you (or they) think they do.

The reason has less to do with technical analysis, hidden fraud or clairvoyance than with statistics, and how they show you will lose your money if you dare to trade in the Ethereum blockchain.

Note: In this context “trade” refers to buy and sell cryptocurrencies regularly (at least once a month).

Scope of the analysis

This analysis was performed on the Ethereum blockchain. Please note it is not the same as an exchange such as Binance, Coinbase, etc.

In the first case, all transactions are public and it is decentralized, thus the ownership of your cryptocurrencies are backed up by thousands of nodes. In the latter, private companies offer a platform to buy and sell cryptocurrencies, but none of those transactions need to be reflected in the real blockchain. Therefore, you do not own your cryptocurrencies, they do. With the promise that they will give you back those if you ask so, of course.

Crypto traders

Let’s start with the basics: there are people who are doing well in the cryptoworld. Some of them are traders that are operating directly in the blockchain. Whether they are real people or bots is not relevant for the purpose of this study. The key factor is that they are making profitable transactions on a regular basis.

One can think of several reasons why these traders are successful, some of them being:

- They have a better understanding of how cryptocurrencies work.

- Have come up with better algorithms/technical analysis than the rest of the traders.

- Have access to better sources of market information.

- Have a huge network of influence.

One or more of the above could explain better results of some of the traders.

Copy trading

If those successful traders could be identified, then it should be possible to copy their transactions and obtain a similar profit, because Ethereum blockchain transactions are public.

This is known as copytrading. There are platforms operating in the stock markets that offer this strategy as a service. However, in these platforms transactions are not public. It is not possible to download millions of those transactions, group them by user and analyze them. But the Ethereum blockchain is different.

Ethereum trader identification

The goal is to identify traders that will make profit with their transactions by examining their past behaviour.

The simplest way to get to the expected result should be as follows:

- Download all trade transactions.

- Group them by user.

- Rank them by the most profitable ones.

There are many ways to rank those users. It could be by total profit, average profit, median profit, percentage, etc. You can try as many as you want, but in any case, whatever method you choose, those at the top of the list should be the savvy ones you were searching for.

Note: It is advisable to reduce outliers as much as possible. We are not interested in having traders who got lucky once at the top of the list. Therefore, average is discouraged in favor of median as it represents a robust measure, much more resistant to outliers.

Let’s pick one of the most conservative and robust measures we could think of to rank traders:

- Group each user’s transactions by month and cryptocurrency.

- Get the median profit for each cryptocurrency for each month.

- Get the median profit of the latter for each month.

- Remove small transactions (minimum 0.5 ETH) .

- Give extra points for each additional month they have traded on.

With those requirements, we should have removed traders who got lucky once, or did well just one month, or are not consistent with their earnings.

1.4 million wallets were processed. Even with strict requirements such as those listed above, there are many traders that have accomplished such an achievement.

Ethereum trade Simulation

Now we have a list of successful traders. Time to simulate their “future” profit!

By “future” we mean we use the test dataset. As we are dealing with statistical analysis we need to divide our data into training and test datasets, to try out our hypothesis. Instead of waiting, said, two months to see how well they performed, we use all data but the last two months to do our analysis, and then the last two months to test what the results would have been.

Unexpected trading performance results

After selecting the successful traders and testing their performance, the results were flat out negative. No significant improvement was experienced. The probability of having profit given the trader had profit in the past had no significant difference from a randomly selected trader.

This questions the initial hypothesis: there should be traders having superior results not because of luck, but because they are better.

As this result was, at first glance, counterintuitive given the popular belief that traders know what they are doing, we decided to dig deeper to ensure we were getting to the right conclusions.

Copy trading analysis

We designed a statistical and Machine Learning approach to clarify whether there are traders that have a significant chance of winning or if it is all due to randomness.

From a pure statistical perspective, a t-test comparing the measured profit between the highest ranked traders and the rest of them was inconclusive, hence the need to dig deeper with this approach.

The intuition is as follows: It is possible that a relation between the trader’s performance and its future profits exists, but it may depend on other variables. Therefore, we collect as much information as we can about the trader’s past performance, plus information about the cryptocurrency that the trader is buying. Now we let Machine Learning algorithms try to find any relation between all that information and the future profit.

If a ML algorithm finds a relation between profit and the trader’s past performance, that will expose the existence of traders that have a better chance to win compared with the others.

You can find the details of this study in this link. To summarize it:

- 43 million transactions were collected and processed.

- Profit is measured when the trader sells or after 30 days (whichever happens first).

- Those transactions were grouped by wallet, cryptocurrency and month.

- Outliers were removed.

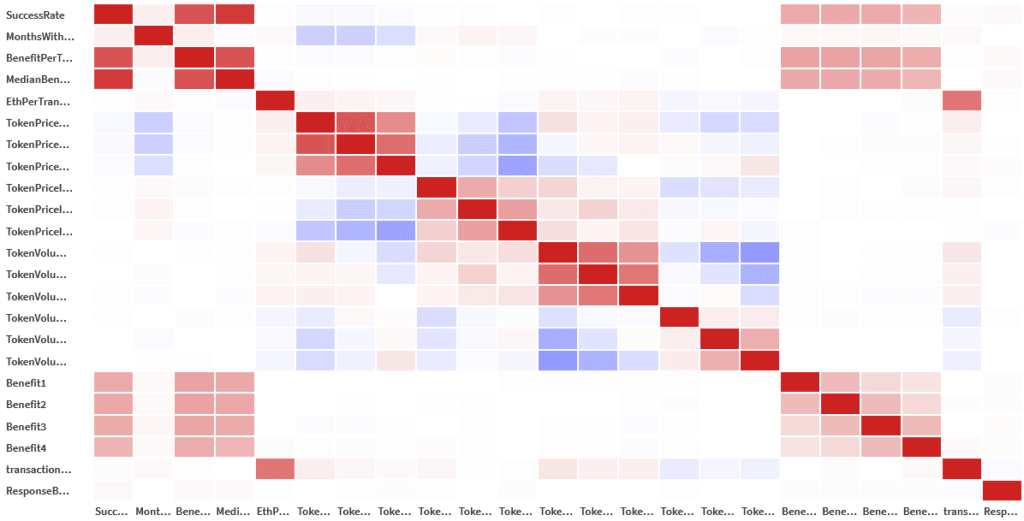

- Univariant analysis was performed.

- Multivariant analysis: Spearman correlation shows a very weak relation.

- PCA.

- Clustering.

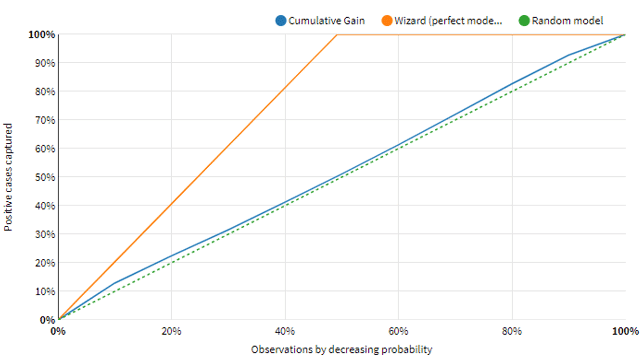

- Machine Learning. Several approaches with different algorithms and metrics.

Results

The findings can be summed up in this two statements:

- No algorithm was able to find a way to select traders that would have profit in their future transactions.

- No evidence has been found that traders that earned profit in the past can earn profit in the future.

This means that most people trading successfully in the Ethereum blockchain, are just lucky, as uncomfortable as this may be to admit. Probably, they have not realized yet, but they will certainly do.

Conclusions

The Ethereum blockchain is an extremely hostile environment for traders. Whatever the underlying reasons for this hostility may be, people getting into the crypto trading will have an insignificant chance of success.

This study also raises the question about whether this may be happening in other similar environments, such as CEXs (centralized exchanges) or even stock markets. Are markets so unpredictable that no investor can profit from them if it is not by pure chance? If that would be the case what the implications would be? Would it be OK for online trading platforms to advertise copy trading? Is it possible that stock markets are driven by millions of traders copying public transactions from the big actors?

Those are questions we cannot answer. In the meantime, it is always important to be extremely careful with all financial investments and do your own research.

More articles in this series about Ethereum blockchain

This article is part of a series of articles about Ethereum blockchain

- We tracked 800 million transactions in the Ethereum Blockchain. Here is how we did it.

- Tracking Ethereum blockchain attackers: Measuring sandwich attacks

- If you trade in the Ethereum blockchain, you will lose your money. Here is why