2023-11-24 13:4:31 Author: securityboulevard.com(查看原文) 阅读量:33 收藏

The Insurance Regulatory and Development Authority of India, or IRDAI, is the foundation that supports insurance market regulation in India.

In this blog, let’s explore the fundamentals of IRDAI and its importance in insurance businesses. We would also highlight the guidelines established by the authority for the insurers and concentrate on the importance of cybersecurity and compliance in detail.

Why IRDAI Compliance is Crucial?

IRDAI Compliance is crucial due to:

Regulatory Mandate: Insurance regulatory compliance is mandatory for insurance companies and intermediaries in India. Adherence to IRDAI’s guidelines is crucial for lawful operations, helping companies avoid penalties and regulatory enforcement.

Consumer Protection: It safeguards the interests of consumers and policyholders. It ensures honest business practices, transparent operations, and proper safeguards for customer information, fostering trust in the insurance industry.

Data Security and Privacy: Insurance Regulatory and Development Authority of India Compliance emphasizes the protection of consumer data. Insurance companies must implement robust cybersecurity measures to secure sensitive information and prevent unauthorized access or breaches.

Guidelines for Insurers (RDA/IT/GDL/MISC/082/04/2017)

- The designation of a suitably qualified and experienced Senior Level Officer as Chief Information Security Officer (CISO), responsible for developing and implementing policies to safeguard their information assets.

- Generate a report on the GAP Analysis that compares the current state (AS-IS) with the requirements outlined in this guidelines document.

- Developing a Strategy for Managing Cyber Crises.

- Approval and Implementation of the Information and Cyber Security Policy by the Board.

- Development of an information and cyber security assurance program (implementation plan/guidelines) aligned with the approved information and cyber security policy by the Board of Directors.

- Successful execution of the initial comprehensive audit for Information and Cyber Security assurance.

- Advisors recommend insurers to perform an annual Vulnerability Assessment and Penetration Testing (VAPT) on their entire ICT infrastructure.

- Any gaps identified in critical applications must be addressed within one month of their identification.

- An annually scheduled audit will be carried out by a certified auditor with qualifications such as CERT-In empanelment.

- Assess reported gaps from documented audits, considering their impact on overall service delivery, usage, scope, and other relevant factors.

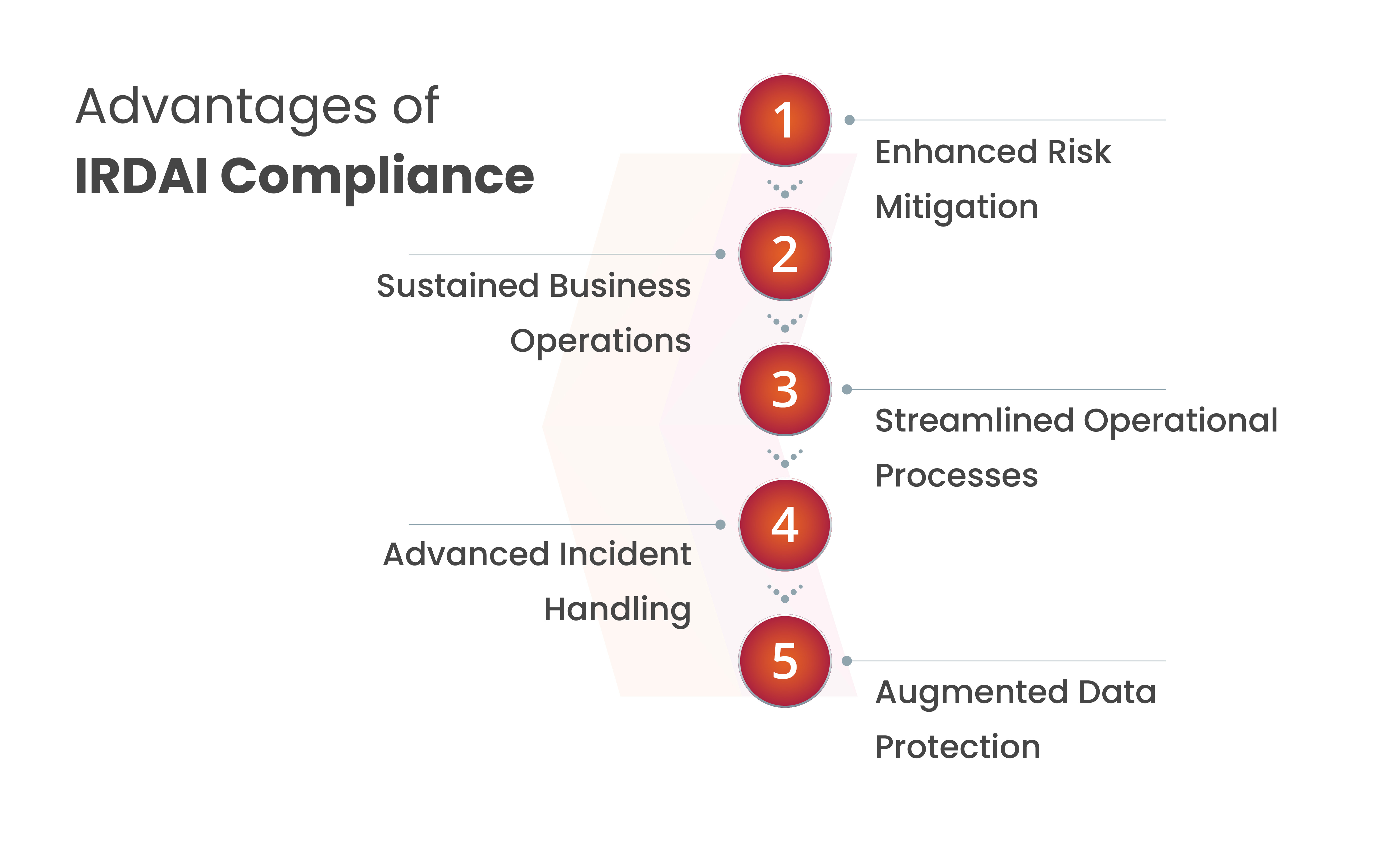

Benefits of IRDAI Compliance

There are several benefits of Insurance regulatory compliance, the same have been listed below:

Improved Risk Management: Proactive identification and resolution of potential threats help in risk and compliance. This helps in enhancing operational resilience.

Business Continuity: Establishment of a robust infrastructure, minimizing disruptions from cyber systems and ensuring continuous operations.

Operational Efficiency: Compliance helps avoid fines, legal action, and reputational harm, contributing to efficient business operations.

Better Incident Response: Mandated incident response plans enable quick and efficient responses to cybersecurity disasters.

Enhanced Data Security: Implementation of strong cybersecurity measures protects client data, fostering customer loyalty and trust.

Book a Free Consultation with our Cyber Security Experts

Risks of Non-Compliant Practices

It is vital to adhere to the regulations set forth by the Insurance Regulatory and Development Authority of India. Securing personal financial data and upholding the integrity of the insurance industry is crucial. In addition to the legal requirement, insurance companies face a wide range of risks when they neglect handling insurance regulatory compliance, including data breaches and government fines.

Insurance businesses may unintentionally ignore or undervalue the complex cybersecurity procedures required by the IRDAI if they lack cybersecurity knowledge. This neglect may result in processing, transmission, and storage weaknesses that open them up to harmful cyberattacks. In addition, non-compliance carries the risk of harsh fines and legal repercussions because the IRDAI has a strict stance on data protection.

Furthermore, since cyber threats are dynamic, one must constantly be on the lookout for new threats and adjust accordingly. Insurance companies may find it difficult to put strong cybersecurity measures in place and keep them updated without their specialized knowledge, which leaves them vulnerable to changing cyber threats. To put the whole company at serious risk, navigating the complicated world of Insurance Regulatory and Development Authority of India compliance without the assistance of cybersecurity experts is like putting the entire organization at significant risk.

Why should businesses choose Kratikal for IRDAI Compliance?

Kratikal, a CERT-In empaneled auditor, is ready to strengthen your defenses against vulnerabilities in accordance with the principles. The business protects data from possible breaches and cyber threats by providing a wide range of coverage options. In addition to improving the insurance sector, it also prioritizes consumer protection and increases transparency. Following security guidelines becomes essential under this framework for a number of reasons, including protecting policyholders’ interests, guaranteeing equitable regulation of the insurance industry, and reducing losses resulting from cybercrime. Companies can contribute to a more secure and resilient insurance landscape by adhering to these standards.

In conclusion, IRDAI compliance goes beyond legal obligations, encompassing consumer protection, data security, privacy, and effective risk management. By adhering to the regulations, insurance companies can enhance risk mitigation, operational efficiency, and data security, fostering trust among consumers. The evolving digital methods and increased cyber threats necessitate continuous adaptation, as reflected in the revised Cybersecurity Guidelines for insurers, ensuring the insurance sector remains resilient and prepared for the challenges of the digital age.

The post What is IRDAI Compliance? Guidelines for the Insurer appeared first on Kratikal Blogs.

*** This is a Security Bloggers Network syndicated blog from Kratikal Blogs authored by Riddika Grover. Read the original post at: https://kratikal.com/blog/what-is-irdai-compliance-guidelines-for-the-insurer/

如有侵权请联系:admin#unsafe.sh