Safeguarding Trade: Discovering the World of Mastercard Digital Guardrails

In our tech-driven era, it is vitro important that financial dealings are shielded competently. A colossal number of exchanges are happening each day, proving the ever growing necessity of sturdy digital protective measures. Mastercard, a global pacesetter in monetary services, actively participates in driving this digital safety evolution. This section cues you into the universe of Mastercard's shield against digital threats, its significance, and how it safeguards global dealings effectively.

Mastercard's digital guardrails exhibit an all-inclusive security architecture that upholds the safety of financial exchanges. It relies on a triad security principle - confidentiality, integrity, and accessibility (CIA). This ensures that private data remains confidential, preserves the original integrity during transition, and stays accessible as required.

<code class="language-python">class MastercardDigitalGuardrails:

def __init__(self):

self.confidentiality = True

self.integrity = True

self.availability = True</code>

The protective structure of Mastercard aspires to safeguard against diverse threats such as data infringement, unauthorised identity usage, and impostor transactions. It achieves this through a concoction of state-of-the-art technological advancements, stringent procedures, and a brigade of seasoned cybersecurity professionals.

| Peril | Mastercard's Strategy |

|---|---|

| Data Breach | Cutting-edge encryption and tokenization |

| Unauthorised Identity Usage | Biometric validation and behaviour-centric algorithms |

| Impostor Transactions | Instantaneous fraud surveillance and AI-enabled predictive analysis |

Mastercard's protective measures are not fixed but are constantly adapting to match the continuously emerging perils in cybersecurity. This includes frequent augmentation of their safety protocols, ongoing surveillance of exchanges, and consistent professional development for their cybersecurity division.

Here we shed light on some exceptional features inherent in Mastercard's digital safety:

-

Cutting-edge Encryption: Mastercard employs novel encryption methodologies that ensure safety during data transition. Irrespective of any data intrusion, the data remains unreadable and unusable by unauthorized personnel.

-

Tokenization: It is a procedure wherein confidential data is swapped with non-sensitive correlated elements known as tokens. This guarantees that data intrusions would not lead to any fraudulent mishaps.

-

Biometric Validation: Mastercard employs biometric authentication techniques like facial recognition and fingerprint scanning to ensure user identity. This additional security layer ensures that unauthorised access to user accounts is essentially challenging.

-

Behaviour-centric Algorithms: These algorithms inspect user behaviour to identify abnormal activity. Any doubtful activity prompts immediate detection and deterrence of potential fraudulence.

-

Instantaneous Fraud Surveillance: Utilizing AI and machine learning techniques, Mastercard analyses operations 'live' to flag any fraudulent indicators. This empowers immediate remediation and preclusion of any dubious transactions.

-

Predictive Analysis: Mastercard utilises predictive analysis to detect and ward off potential hazards and vulnerabilities preemptively. This forward-looking approach helps them to stay ahead of any potential cybersecurity threats.

Ultimately, Mastercard's digital safeguard constitutes a robust and all-inclusive architecture that assures transaction safety and user data security. It represents Mastercard's unwavering commitment towards ensuring secure monetary trades globally. In the ensuing chapters, we shall delve deeper into the complexities of Mastercard's digital safeguard methods, and understand how they are turning the tide against cyber threats.

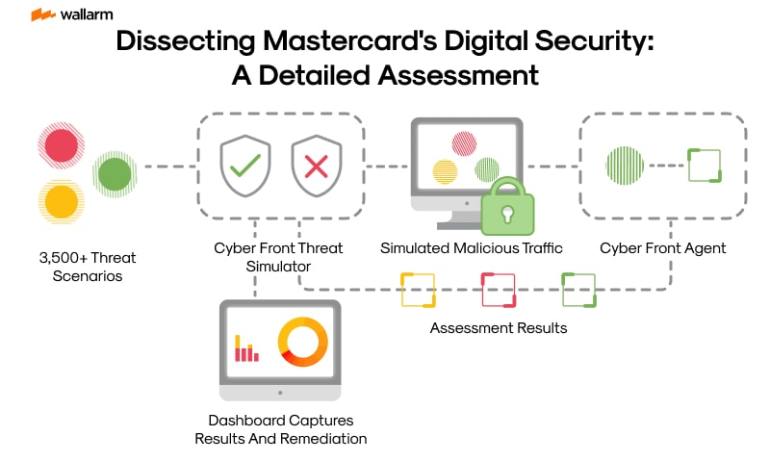

Dissecting Mastercard's Digital Security: A Detailed Assessment

Mastercard's proactive stance on digital safety incorporates a complex blend of avant-garde technologies, inventive manoeuvres, and stringent methodologies. This segment will unpack the digital security at Mastercard, providing a comprehensive examination of its construction and operation.

The digital security design at Mastercard is established on three cardinal constituents: Dissuasion, Recognition, and Impediment.

1. Dissuasion: Mastercard adopts a multi-layered tactic to parry digital risks. Included are techniques for data obfuscation, deployment of token-based measures, and biometric approval procedures.

Data obfuscation or encryption transforms data into a distinct cryptographic string to prevent unauthorized intrusion. Mastercard champions advanced data obfuscation methodologies (AES) to bolster sensitive data. A basic sketch of how AES operates can be outlined as:

<code class="language-python">from Crypto.Cipher import AES cipher = AES.new(secret_key, AES.MODE_ECB) encrypted_text = cipher.encrypt(plain_text)</code>

Token-based measures replace important details with unique identification symbols (tokens), preserving critical data without compromising security.

Biometric approval confirms a user's identity through unique physical or behavioural characteristics, boosting security standards.

2. Recognition: Mastercard utilizes developments in artificial intelligence (AI) and machine learning (ML) for detecting threats. These systems examine patterns and anomalies in transactional data to identify suspicious activities.

3. Impediment: Following a security breach, Mastercard flaunts a robust crisis management plan. It includes isolating the affected systems, determining the source, and initiating recovery procedures.

Mastercard's digital protection model also comprises a comprehensive risk governance strategy that identifies potential hazards, determines their potential effect and establishes processes to mitigate their impact.

Mastercard's digital safeguarding measures continually evolve in response to the nascent universe of threats. Their constant investment in research and advancement secures an edge over emerging digital risks.

To understand the proficiency of Mastercard's digital protection model, let's jot it down in comparison with the general industry criterions.

| Digital Security Measures | Mastercard | Industry Average |

|---|---|---|

| Data Obfuscation | AES | DES |

| User Approval | Biometric | Password-based |

| AI/ML Deployment | High | Moderate |

| Breach Recovery Time | < 1 hour | 3-4 hours |

The table illustrates that Mastercard's digital security practices surpass traditional industry norms significantly.

In conclusion, Mastercard's digital safety is a complex, adaptive system amalgamating top-notch technology, innovative tactics, and rigid guidelines. It highlights Mastercard's commitment to preserving client data and fostering trust in their brand.

`

`

Pioneering Pathways in Cybersecurity: An Exploration into Mastercard's Groundbreaking Techniques

Mastercard incessantly endeavors to enhance its technological proficiency while guaranteeing complete protection of customer data. The company's approach to cybersecurity is diverse and dynamic, inclusive of robust deterrent techniques, state-of-the-art technology application, and cultivating a workforce aware of security mandates. This chapter introduces Mastercard's pioneering strategies in strengthening their cybersecurity blueprint.

1. Preemptive Stratagems

Mastercard advocates a preemptive stance over a reactive approach when considering cybersecurity. Their priority lies in formulating strategies designed to thwart cyber threats rather than dealing with them after materialization. Mastercard's proactive approach involves continuous external surveillance to identify potential threats, allowing them to address these vulnerabilities before they become problematic.

The company makes optimal usage of advanced threat intelligence applications for data collection and scrutiny on prospective cyber hazards. This information is pivotal in strengthening their data protection barriers and serves as a strategic guide should there be a looming attack.

2. Advanced Tech Application

Mastercard uses an assortment of avant-garde tech tools to safeguard their networks against potential cyber threats. Their technology suite includes AI, machine learning algorithms, and blockchain technology which aid in forecasting and warding off cyber-attacks efficiently.

Consider Mastercard's Detection Intelligence system as an example: it utilizes AI for analyzing cardholder behavior and transaction trends. This analysis helps in identifying and preventing fraudulent transactions even before they occur.

<code class="language-python"># A sample Python code sketch showing how Mastercard might use AI for scam detection. import pandas as pd from sklearn.ensemble import RandomForestClassifier # Unpacking the transaction data data = pd.read_csv('transaction_data.csv') # Defining the target and features target = 'fraud' features = data.columns.remove(target) # Segmenting data into training and testing sets train_set, test_set = train_test_split(data, test_size=0.2) # Training the random forest classifier classifier = RandomForestClassifier() classifier.fit(train_set[features], train_set[target]) # Predicting possible fraud in testing data guesses = classifier.predict(test_set[features])</code>

3. Encouraging Security Mindfulness

Mastercard promotes security cognizance within its workforce. The company periodically organizes workshops and training sessions aimed at keeping their employees abreast of the latest cybersecurity developments and efficient tactics for protecting crucial data.

4. Alliance and Cooperation

Mastercard believes cybersecurity is a collective duty and not an individual endeavor. Accordingly, the company maintains synergies with various institutions, governmental entities, and law enforcement agencies to exchange threat insights and devise effective countermeasures. Such collaboration enables Mastercard to stay ahead in the ever-changing landscape of cybersecurity threats.

5. Adherence to Legal Mandates

Mastercard is devoted to conformity with all applicable cybersecurity protocols. The company employs a specialized team to ascertain their cybersecurity ventures are in line with international norms and are legally compliant.

All things considered, Mastercard's comprehensive cybersecurity strategy is a blend of active protection measures, modern technology, promoting security consciousness, concerted efforts with relevant institutions, and strong adherence to regulatory norms. This amalgamated approach enhances the company's defensive shield against cyber threats thus reinforcing the safety of their customer data.

The Strategy Behind Mastercard's Triumph Over Cybersecurity Menaces

In the financial services universe, Mastercard shines brightly, playing a big part in the ongoing battle against digital threats. We will now explore the unique approach that Mastercard implements to emerge victorious against these digital menaces.

1. Forward-Thinking Digital Threat Insight

The cornerstone of Mastercard's defensive strategy is its proactive nature. The firm leverages leading-edge digital threat analysis tools, which anticipates and counteracts potential cyber perils before their manifestation. These tools deep dive into patterns and trends in digital threats, which provides Mastercard the edge over cyber felons.

<code class="language-python"># Code snippet illustrating digital threat analysis tool's working

def explore_threat_patterns(digital_threat_info):

for threat in digital_threat_info:

if identify_pattern(threat):

initiate_defensive_step(threat)</code>

2. Sturdy Cyber Defense Framework

Mastercard channels substantial resources into constructing a sturdy cyber defense matrix. This comprises cutting-edge firewalls, invasion spotting systems, and fortified data repositories. These elements ensure a nearly invincible digital fortress around Mastercard's network.

| Defense Mechanism | Explanation |

|---|---|

| Firewalls | Safeguards the network from unauthorized intrusions |

| Invasion Spotting Systems | Scans the network for any doubtful activity |

| Fortified Data Repositories | Offers a safe haven for Mastercard's servers |

3. Progressive Verification Techniques

Mastercard deploys innovative verification steps to shelter client data. Biometric verification, varied-factor authentication, and data tokenization are some practices incorporated. These ensure that only permissible parties can tap into confidential information.

- Biometric Verification: Validating identity based on distinctive physical traits like fingerprints or facial recognition.

- Varied-Factor Authentication: Incorporates numerous layers of verification for authenticating a user.

- Data Tokenization: Converts sensitive data into unique ID symbols which hold all the valuable data details without jeopardizing safety.

4. Promotion of Cybersecurity Knowledge and Consciousness

Mastercard firmly believes that the digital threat war isn't just about the tech, but also knowledge and awareness. Hence, they introduce comprehensive programs for their workforce, ensuring they are informed of recent digital perils and how to thwart those.

5. Synergies with Law & Order Entities and Cybersecurity Enterprises

Mastercard constantly teams up with law enforcement bodies and cybersecurity companies across the globe. This helps them exchange digital threat insights, cooperate during inquiries, and deal more effectively with digital threats.

6. Ongoing Inspection and Enhancement

Flexibility sits at the core of Mastercard's shield strategy. Regular assessment and enhancement of security mechanisms are an integral part of their routine. This ensures their defensive measures remain current and potent against the ever-evolving digital threats.

Finally, Mastercard's triumph over digital threats is the result of a mix of adjacent-edge tech, strong guidelines, and preemptive activities. The holistic defensive approach enables safeguarding of both their network and client data against even the most complex digital threats.

Unveiling the Cybersecurity Standards of Mastercard

As a titanic player in the domain of monetary services, Mastercard has made its mark by initiating and upholding modern-day cybersecurity practices. The firm's dedication to preserving client information and certifying the safety of transactions is evident through its sturdy cybersecurity systems. This segment delves deeper into the particular details of Mastercard's digital protection efforts, revealing the progressive techniques and tactical approaches employed by the firm.

1. Tiered Digital Security Infrastructure

The cyber defense policy of Mastercard is designed on a tiered safety network. This technique reassures that even if a specific tier is compromised, the additional tiers continue unaffected, furnishing an extra frontline of defense.

<code class="language-python">class MastercardProtection:

def __init__(self):

self.tiers = ['Tier1', 'Tier2', 'Tier3', 'Tier4']

def assess_safety(self, tier):

if tier in self.tiers:

print(f"{tier} is secured.")

else:

print(f"{tier} is breached. Moving to the next tier.")</code>

2. Contemporary Fraud Recognition and Avoidance

Mastercard utilizes the most recent machine comprehension algorithms for instantaneous fraud recognition and avoidance. These algorithms scrutinize transactional facts to discern schemas and oddities which could denote fraudulent conduct.

<code class="language-python">import pandas as pd from sklearn.ensemble import IsolationForest # Import transaction facts facts = pd.read_csv('transaction_facts.csv') # Start-up the Isolation Forest algorithm algorithm = IsolationForest(contamination=0.05) # Train the algorithm algorithm.fit(facts) # Detect the outliers in the facts outliers = model.predict(facts) # Display detected outliers print(outliers)</code>

3. Mastercode Secure System

Mastercard's Mastercode system presents an additional safety tier for online monetary exchanges. This system necessitates users to input a distinct code during checkout, substantiating that only the valid card owner has the authority to finalize the purchase.

<code class="language-javascript">function verifyMasterCode(inputtedCode, actualCode) {

if (inputtedCode === actualCode) {

return "Exchange Certified";

} else {

return "Invalid MasterCode. Exchange Rejected";

}

}</code>

4. Symbolization

Mastercard deploys symbolization as a method of protecting user data during exchanges. Instead of sending actual card specifics, a distinctive symbol is crafted and utilized for the exchange, curtailing the chances of hackers obtaining card specifics.

<code class="language-java">public class Symbolization {

public static String originateSymbol(String cardDigits) {

// Steps to create a unique symbol based on the card digits

}

public static String applySymbol(String symbol) {

// Steps to incorporate the symbol in an exchange

}

}</code>

5. Acquisition of NuData Safety

Mastercard's procurement of NuData Safety, a firm specializing in user activity analysis and biometric techniques, has amplified its digital safety efforts. The technology offered by NuData assists Mastercard in discerning fraudulent behavior by analyzing user activity schemas and biometric specifics.

<code class="language-python">from nudata import NuData # Setting up NuData nudata = NuData() # Examining user activities activity_examination = nudata.scan_activities(user_specifics) # Output the examination print(activity_examination)</code>

Mastercard's digital safety efforts are an attestation of the firm's fidelity to safety. By employing contemporary techniques and creative tactics, Mastercard is sculpting the benchmark for digital safety in the monetary services sector. The strategic approach of the company serves as an inspiration for several organizations, highlighting the significance of proactive and holistic digital safety procedures in today's technologically advancing era.

Profiling the Superior Cybersecurity Approach of Mastercard

Mastercard is distinguished in its dedication towards protecting the confidentiality and transactional integrity of its clients. This section explores the nuances of Mastercard's cybersecurity provisions, accentuating the distinguishing attributes that earn it an exemplary status.

1. Holistic Threat Management

The cybersecurity blueprint of Mastercard is rooted in a well-rounded threat management strategy. This endeavor seeks to identify, evaluate, and devise countermeasures against potential risks. To account for all conceivable dangers, Mastercard employs sophisticated threat evaluation technologies and techniques.

<code class="language-python"># Mastercard's model for risk management in pseudocode

def threat_control(potential_risks):

for risk in potential_risks:

danger = determine_danger(risk)

counteraction_plan = formulate_plan(danger)

apply_plan(counteraction_plan)</code>

2. Stout Defensive Architecture

The protective infrastructure of Mastercard is vigorous and resilient, comprised of varied safety tiers including firewalls, breach detection mechanisms, and data encoding solutions. The tiered setup acts as a failsafe, ensuring continued defense even if one level is compromised.

| Defense Tier | Purpose |

|---|---|

| Firewalls | Restrict unauthorized network intrusion |

| Breach Detection Mechanisms | Identify possible security infringements |

| Data Encoding Solutions | Safeguard data during transitions |

3. Cutting-Edge Cybersecurity Measures

Mastercard spearheads the charge in cybersecurity novelty. The company offers an array of ingenious provisions, like biometric verification and AI-enabled threat identification systems. These pioneering solutions augment security while also enhancing the user experience.

- Biometric Verification: Utilizes distinct bodily traits, like fingerprints or facial structure, for user identification.

- AI-powered Threat Identification: Applies machine learning for real-time detection and response to potential dangers.

4. Preemptive Threat Alert System

Mastercard's cybersecurity strategy is one of prevention over cure. The company recruits an exclusive team for threat intelligence, tasked with ceaselessly surveying the cyber realm for nascent dangers. This anticipatory stance empowers Mastercard to outmaneuver cybercriminals.

<code class="language-python"># Mastercard's strategy for threat intelligence in pseudocode

def danger_alert():

while True:

risks = scan_cyber_environment()

if risks:

counter_risks(risks)</code>

5. Unshakeable Regulatory Adherence

Mastercard functions in a severely regulated sector and maintains an unwavering compliance outline. The company conforms to all pertinent privacy and data protection legislations and routinely scrutinizes its cybersecurity operations for regulatory adherence.

| Adherence Aspect | Goal |

|---|---|

| Data Protection | Guarantees the secure handling and storage of client data |

| Privacy | Upholds and safeguards client privacy |

| Regulatory Adherence | Certifies that all cybersecurity protocols align with regulatory stipulations |

Mastercard's cybersecurity strategy exemplifies the efficient safeguarding of clients and their data by a financial institution. Its stalwart approach combining all-rounded risk management, stalwart defense infrastructure, advanced solutions, anticipatory threat intelligence, and staunch regulatory adherence distinguish it as a cybersecurity frontrunner. This exemplary case study provides a reference point for other organizations looking to amplify their own cybersecurity protocols.

`

`

Peering into Tomorrow: Transforming Cybersecurity at Mastercard

As we gaze at the horizon, Mastercard's cybersecurity path is gearing up to morph and adjust to the ever-evolving panorama of digital dangers. The establishment is not complacent, instead, it is extending the horizons of what's achievable in the domain of cybersecurity. This chapter will explore the prospective avenues of Mastercard's cybersecurity, spotlighting the ground-breaking tactics and state-of-the-art technologies poised to reconceptualize the company's commitment to transaction safety.

1. Artificially Intelligent Mechanisms and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are on the cusp of impacting Mastercard's cybersecurity trajectory critically. These technological tools are expected to lay the groundwork for apprehending patterns in data, equipping Mastercard with the capability of preempting and curtailing possible threats before their emergence.

<code class="language-python"># Sample code for implementing AI in cybersecurity

def forecast_threat(input):

system = load_pattern('threat_pattern.h5') # Load AI pattern

anticipation = system.evaluate(input) # Evaluate possible threat

if anticipation > 0.5:

return "Potential Danger Identified"

else:

return "No Danger Identified"</code>

2. The Blockchain Promise

Mastercard also has its sights set on harnessing the power of blockchain technology to fortify transactional security. Utilizing the dispersed and unalterable attributes of blockchain, Mastercard aspires to construct a safe ecosystem for transactions that can be corroborated without a central authority.

| Conventional Transaction Verification | Blockchain Powered Verification |

|---|---|

| Central authority dependence | Relative autonomy |

| Susceptible to sole failure point | Absence of single point failure |

| Risk of data manipulation | Permanent data logs |

3. Quantum Computing Potential

Quantum computing holds an allure for Mastercard. Thanks to its capacity to handle vast quantities of information at unparalleled speeds, quantum computers bear the promise of dramatically elevating Mastercard's abilities in identifying and reacting to cybersecurity threats.

<code class="language-python"># Sample code for implementing quantum computing in cybersecurity from qiskit import QuantumCircuit # Construct a quantum circuit qc = QuantumCircuit(2) # Use a Hadamard gate qc.h(0) # Use a controlled-NOT gate qc.cx(0, 1) # Display the quantum circuit print(qc)</code>

4. Biometric Authentication Era

Further, Mastercard anticipates utilizing biometric validation methods such as digital fingerprinting and facial recognition to strengthen transaction safety. These techniques render a superior protective layer compared to customary password-centric authentication.

| Classic Password-Centric Authentication | Biometric Identity Verification |

|---|---|

| Susceptible to breaches | Superior protection |

| Risk of forgetting or theft | Individual-specific |

| Requires manual entry | Rapid and automated |

To sum up, Mastercard's cybersecurity future appears bright. With a focus on pioneering methods and embracing state-of-the-art technologies, Mastercard is all geared up to remain a step ahead in successfully countering cybersecurity threats. Unyielding in its dedication to transaction surety and data protection of customers, the company's future strategies mirror this commitment. As we step into tomorrow, the cybersecurity safeguards at Mastercard shall continue its evolutionary journey, pushing the envelope in transaction safety norms.

如有侵权请联系:admin#unsafe.sh