2024-6-14 13:49:38 Author: securityboulevard.com(查看原文) 阅读量:2 收藏

The Insurance Regulatory and Development Authority of India (IRDAI) plays a crucial role in overseeing and advancing the insurance sector in India. Founded in 1999 as an autonomous and statutory body, IRDAI compliance acts as the principal regulator for the insurance industry both domestically and internationally. Its primary mission is to protect policyholders’ interests while promoting the growth and stability of the insurance industry. In this blog let’s explore the role of IRDAI in the insurance sector.

What is IRDAI Compliance?

IRDAI represents the Insurance Regulatory and Development Authority of India, which serves as the regulatory body overseeing the insurance sector in the country. Responsible for monitoring the operations of insurance companies within India, IRDAI compliance sets forth a range of guidelines and directives governing the industry.

With the primary objective of safeguarding the interests of policyholders and fostering the comprehensive growth of the insurance sector, IRDAI regularly issues notifications to insurance firms regarding any modifications in regulatory frameworks. These actions are aimed at promoting operational efficiency among insurance entities and ensuring compliance with prescribed standards. Furthermore, IRDAI compliance exercises authority over matters concerning insurance rates and related charges, contributing to the maintenance of a fair and transparent insurance marketplace.

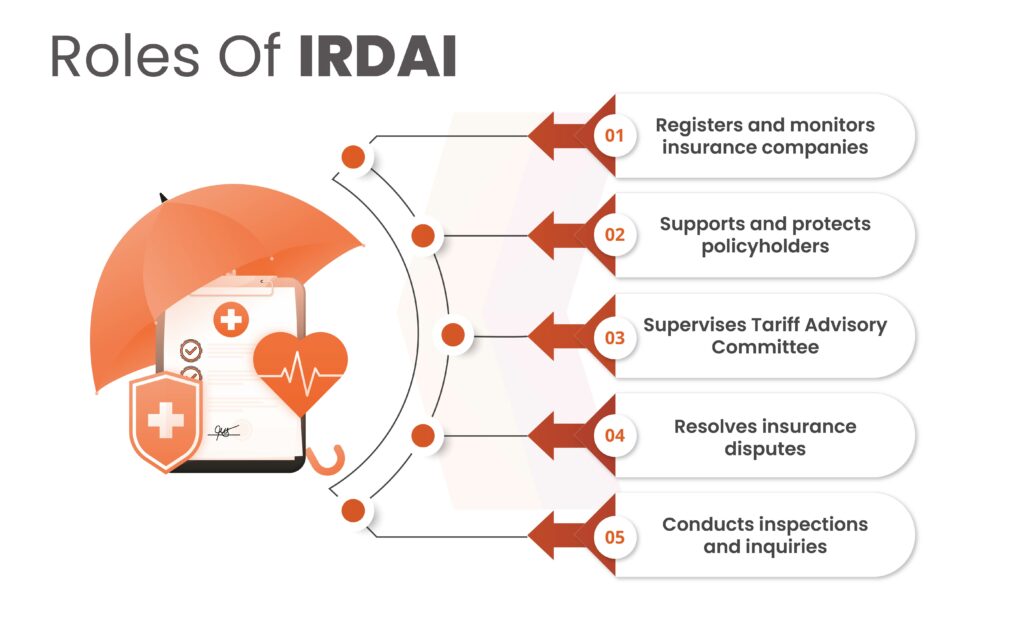

Role of IRDAI in Insurance Sector

IRDAI compliance is instrumental in developing and implementing regulatory mechanisms within the insurance industry. Below is the role of IRDAI compliance in the insurance sector:

- IRDAI safeguards the interests of policyholders.

- Accelerate the orderly growth of the insurance industry for the benefit of the common man.

- Provide long-term funding to boost the nation’s economy.

- Promote, establish, enforce, and monitor high standards of integrity, fair dealing, financial soundness, and competence among insurance providers.

- Ensure that legitimate claims are settled swiftly and efficiently.

- To prevent malpractice and fraud, the IRDAI has established a grievance redressal forum to protect policyholders.

- IRDAI promotes transparency, fairness, and systematic conduct within the insurance sector in financial markets.

- Develop a reliable management system to ensure insurers adhere to high standards of financial stability.

- Take appropriate action when such high standards are not maintained.

- Ensure optimal self-regulation within the industry.

Objectives of IRDAI Compliance

The primary objective of the Insurance Regulatory and Development Authority of India (IRDAI) is to implement the provisions of the Insurance Act. The objectives of the IRDAI compliance is as follows:

- It protects the interests of policyholders and ensures they are treated fairly.

- IRDAI compliance impartially regulates the insurance industry and ensures its financial stability.

- To consistently establish regulations that ensure the industry operates clearly and without ambiguity.

Features and Benefits of IRDAI Compliance

Here are some of the key features and benefits of the Insurance Regulatory and Development Authority of India (IRDAI).

- Serves as the regulatory authority for the insurance sector.

- Protects the interests of policyholders.

- Establishes rules and regulations under Section 114A of the Insurance Act of 1938.

- Authorizes the issuance of registration certificates to new insurance companies wishing to operate in India.

- Monitors the activities of the insurance industry to ensure the continuous growth of both insurers and policyholders.

- Regulates insurance rates, terms, conditions, and benefits offered by providers to policyholders.

- Conducts inspections and audits of insurance companies, intermediaries, and related organizations to prevent malpractice and protect policyholders from fraud.

Why Kratikal for IRDAI Compliance?

Kratikal, as a CERT-In empanelled auditor, can assist you in safeguarding against vulnerabilities based on the IRDAI guidelines. We assist organizations by providing a variety of coverage alternatives to help protect data from data breaches and other cybersecurity vulnerabilities.

IRDAI aims to improve the insurance business, simultaneously improving its transparency and focus on protecting consumers’ interests. The following are the reasons why the appropriate security recommendations must be followed:

1. To protect the policyholder’s interests.

2. Fair regulation of the insurance industry and reduce the threat landscape.

3. To minimize loss due to cyber fraud.

In addition to improving the insurance sector, it also prioritizes consumer protection and increases transparency. Following security guidelines becomes essential under this framework for a number of reasons, including protecting policyholders’ interests, ensuring equitable regulation of the insurance industry, and reducing losses resulting from cyber-attacks. Companies can contribute to a more secure and resilient insurance landscape by adhering to these standards.

Conclusion

IRDAI compliance goes beyond legal obligations, encompassing customer protection, data protection, privacy, and effective risk management. By complying with regulations, insurance companies can maximize risk mitigation, efficiency, and data security, and build consumer confidence. Evolving digital channels and the rise of cyber threats require continuous adaptation, as reflected in revised cybersecurity guidelines issued to insurers.

Kratikal is the top choice for many discerning organizations due to its recognition as a CERT-In empanelled auditor. Our extensive services, and our commitment to individualized, VAPT, and Compliance solutions make us set a standard. When it comes to securing your digital assets and ensuring compliance, Kratikal leads the way.

FAQs

- Why is IRDAI required?

The key objectives of the IRDAI include protecting the interests of policyholders and ensuring the speedy and orderly growth of the insurance industry. It aims for the swift settlement of genuine claims and maintains an effective grievance redressal mechanism

- Who regulates IRDAI?

The Insurance Regulatory and Development Authority of India (IRDAI) is an autonomous statutory body under the Ministry of Finance, Government of India. It is responsible for regulating and licensing the insurance and reinsurance industries in India.

The post What is IRDAI Compliance and Its Role appeared first on Kratikal Blogs.

*** This is a Security Bloggers Network syndicated blog from Kratikal Blogs authored by Shikha Dhingra. Read the original post at: https://kratikal.com/blog/what-is-irdai-compliance-and-its-role/

如有侵权请联系:admin#unsafe.sh